Uganda's Infrastructure Investment Promise

Construction worker in Uganda: more infrastructure and oil sector investment could boost growth (photo: James Akena/Reuters/Newscom)

July 19, 2017

Drought, slow credit growth, and indirect effects of regional conflict are taking their toll on Uganda, but infrastructure and oil sector investment could boost growth over the next 3–5 years, said the IMF in its annual assessment of the Ugandan economy.

After two decades of growth averaging 8 percent per year, the IMF estimates it at 3.9 percent for the 2016/17 fiscal year that ended in June, and 5 percent for this fiscal year that started in July. With population growth of around 3 percent, this puts per capita growth at only 1-2 percent. The drought in the Horn of Africa, a slowdown of credit to the private sector, and indirect effects from regional conflict such as reduced trade flows are part of the story.

Uganda’s strong performance in the past—largely attributed to sound policy decisions and a reliance on the private sector as the main engine of growth–helped reduce the poverty rate by more than half. But the country’s economy has slowed since 2010, and conditions for the average Ugandan are not improving fast enough. The report shows social spending is set to decline as a share of GDP and is below average for the region.

Reinvigorating growth

The government is working to return Uganda to higher growth rates and move the country towards middle-income status. The development strategy is focused on addressing infrastructure bottlenecks by building hydropower plants, a modern road network, and railways. In addition, Uganda is developing oil fields with an international consortium of oil companies. The crude oil will be transported to international markets via a pipeline through Tanzania and supply a planned domestic refinery.

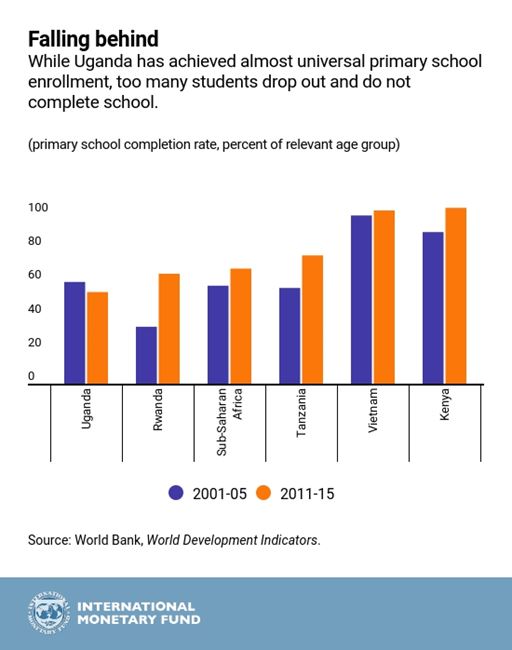

The report notes that, in parallel, attention to social spending on health and education is needed to ensure that all Ugandans can seize the opportunities offered by improved infrastructure and regional integration in the East African Community. For example, primary school completion rates have recently declined and are lower than those of peers.

Accessing larger markets

The ongoing economic integration in the East African Community provides opportunities for Ugandan firms to benefit from a larger market and better linkages. Good infrastructure combined with a skilled workforce and an enabling business environment are the ingredients for Uganda to benefit from these opportunities and achieve high rates of growth. Uganda’s business environment has improved over the last decade, but lags that of other countries in the East African Community where even more progress has been made.

- Population: 37 million

- Capital: Kampala

- Currency: Ugandan Shilling

- Life Expectancy: 59 years

- Adult literacy rate: 74%

- GDP per capita: US$690

- Poverty ratio: 35%

Making the development strategy work

Given that infrastructure investment is mostly financed through borrowing from abroad, public debt is on the rise. And the report says the investment must yield a return in the form of higher growth if this trend is to be reversed again. This requires improvements in the way the government plans and executes investment projects.

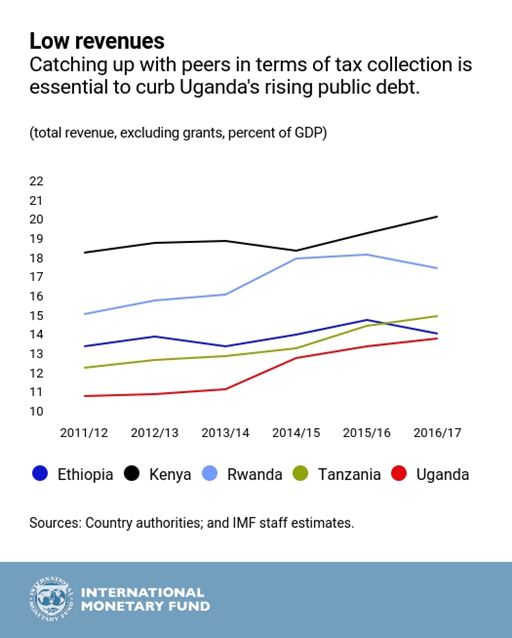

Moreover, Uganda’s revenue collection is low, for example, relative to its peers in the East African Community. The study emphasizes that the government should continue with its strategy to increase tax revenues by ½ percent of GDP per year. Over the medium term, higher growth, with increased tax collection, and with the infrastructure program completed, will make the overall fiscal deficit converge to its 3 percent of GDP target to ensure that public debt declines again.

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.